Introduction

Retailers and resellers need to plan and organize on two major aspects during any festival season. The first one involves retail inventory planning; second how to increase instore footfall or online shoppers ( for e retailing) through promotions and gifts. During festive season, there is a peak in the local retail cycle as families prepare for the festivities and shoppers seek household essentials (foods and beverages etc.), non-essentials (apparels and textiles etc.) or gifts.

Since 2020 against the backdrop of COVID-19, the retailers had to make serious adjustments. Leading to focus on driving e retailing to never-before-seen realms. However 2022, market feedback suggests, it will be more of a hybrid, with brick-and-mortar retail matching online shopping platforms on offers and merchandise mix.

The current supply chain and on-going political events surrounding Ukraine war has created more uncertainties to be dealt with. Ensuring enough supplies that too within reach of the shoppers at competitive price is a major challenge.

Here are some insights on how retailers, resellers and e-retailers are confronting dual challenge of costs and stocks for upcoming festive seasons

Retail Sales Associate

Store associates are on the frontline and face an increasingly connected consumer. Thereby shifting the balance of power to the online shoppers , even inside a store. For retailers, it could be a challenging situation.

A recent Kearney study showed that physical stores play a strong role across all categories of personal items that may need more touch and feel. Shoppers prefer to buy clothes, bags and accessories in store. The contributing factors are convenience (51 per cent), an enhanced shopping experience (49 per cent) and competitive pricing (44 per cent).

These are challenging expectations for any retailer to meet. In other words much relies on the store associates to deliver a branded, engaging experience and complete a transaction.

These younger, connected consumers want much more than a purchase transaction, and are looking for personalized branded shopping experiences to enhance their own personal brand ‘story’. What they buy, where they buy it, and how they buy it all becomes part of the story they share with friends and followers on social media.

In this social media connected ecosystem store associates are being trained – becoming more of an in-store ‘friend’, adviser, influencer and problem solver – and in the right store environment with a new retail approach.

Supply chain

Supply chain is becoming an issue for a third straight year. Thankfully many retailers are of the view that most popular business categories are minimally impacted. The popular categories during festive season are beauty and Personal Care or apparels and textiles. Retailers are closely working with BRAND Partners to ensure assortment and inventory pro-actively.

Price Inflation

Current trends indicate that physical retail is back to near full form. Shoppers are expecting sales events or promotion activities such as ‘crazy deals’, raffles, and limited-time ‘frenzy offers’.

Keeping in view current price inflation, the range of promotions offered online and offline are expected to be reduced drastically. Retailers are working on selective offers and carefully choosing product lines to maintain festive pull with minimum impact on bottom line.

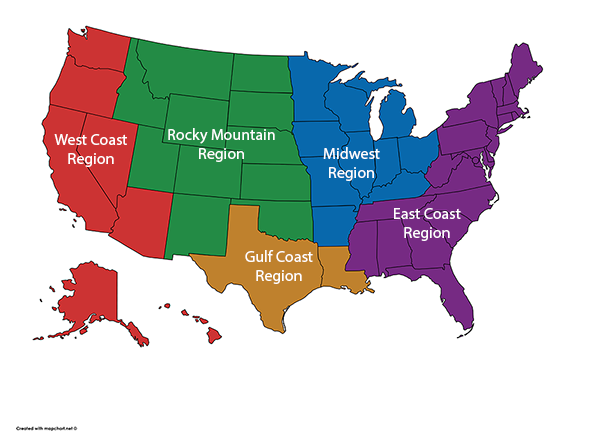

Local and Regional vendors

Categories like grocery, consumables etc. occupy major chunk of shopping basket. In anticipation of a significant spike during this time, retailers are working on locally sourced essentials. They intend to keep home grown consumables account as sizable portion of inventory.

Local and regional vendors seems now to have a decisive price advantage. Most of the franchises are creating retail format to provide local sellers with a local platform and tools for selling online. Thereby creating opportunities for local vendors who don’t rely on imports. It is right time for local vendors to take advantage and offer customers a wider range of options, prices, and service quality.

New fulfilment centres by e retailers

Large retailers and resellers are building infrastructure to operate multiple fulfilment centres across operating zones. Enabling them to deliver products to millions of customers across the country quickly. Current logistics and fulfilment network also include CFCs (customer fulfilment centres), last-mile hubs, and gateway hubs.

Buy Now Pay Later

Both online retailers and physical resellers are joining hands with fintech companies to provide financial incentives. Many fintech are working on models to offer tailored support and guide them in the selling process.

Conclusion

Retail ROI is not just the transaction. Other factors affecting influencing includes the customer response to the experience. This not only promotes online shoppers get their personal brand story. Also helps retailers to collect data along with a positive word-of-mouth recommendation.

In this new omnichannel, hyper-connected retail world, retailers and resellers are changing and re-establishing processes across all the formats. If shoppers want a (literally) dramatic in-store shopping experience, future retailers need to recreate stores as shopping theatre.